A real estate transaction taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

, or property transfer tax, was first introduced uniformly across Germany in 1909. After the federalism reform in September 2006, Germany’s federal states could autonomously choose the rate at which to levy the tax. The real estate transaction tax is levied on the gross sales value of a property when it changes ownership, without deductions for investment or purchasing costs. This makes the tax particularly harmful to investment in buildings and structures.

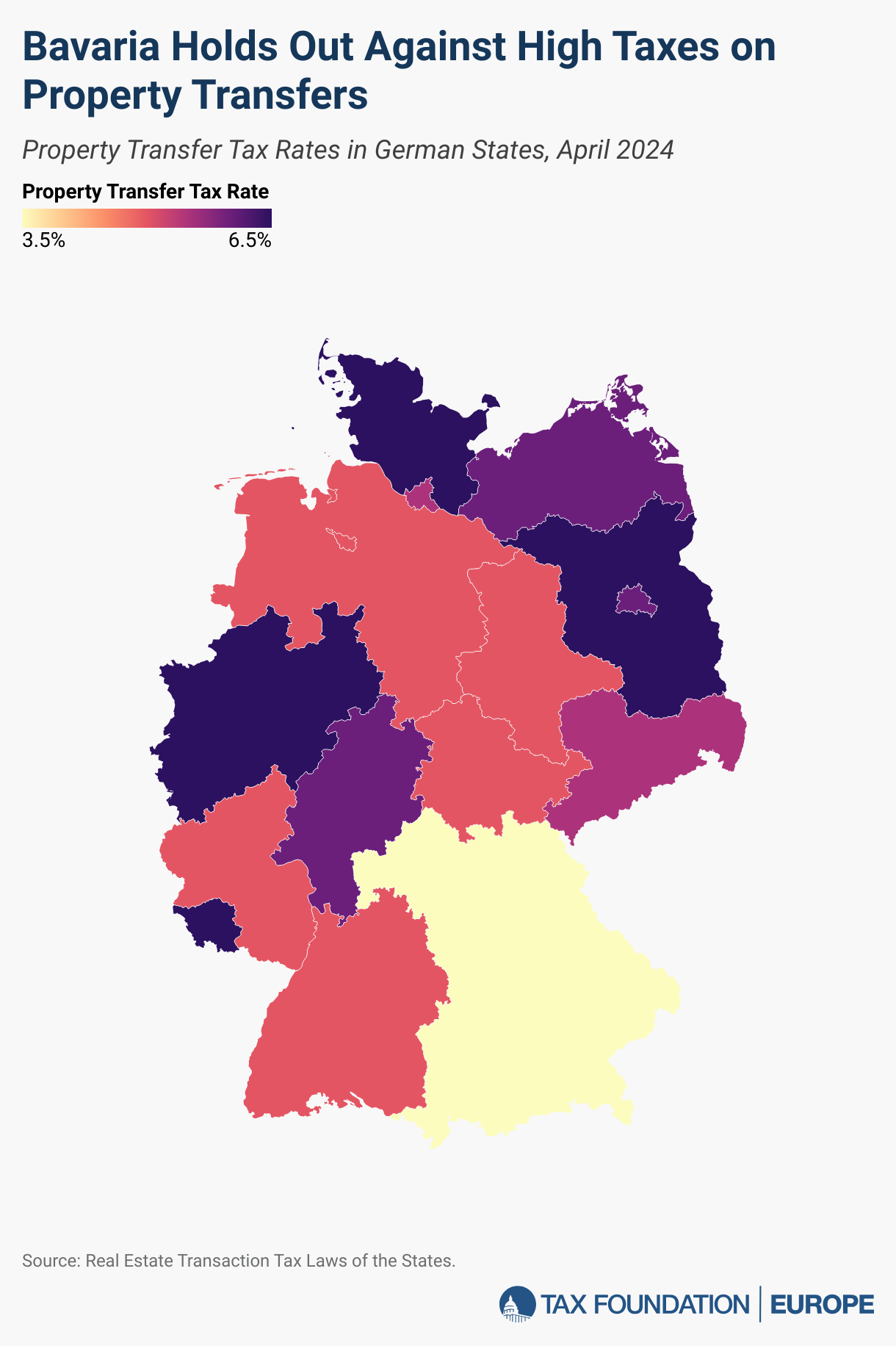

Prior to September 2006, the federal rate was set at 3.5 percent. Since then, the average rate has moved up to 5.53 percent in 2024. The states of Brandenburg, North-Rhine Westphalia, Saarland, and Schleswig-Holstein levy the highest rate at 6.5 percent. Bavaria is the only state that maintains the low rate of 3.5 percent today.

In the past two years, several states have changed their transfer tax rates. In January 2023, Hamburg increased its rate from 4.5 percent to 5 percent and Saxony from 3.5 percent to 5 percent. In January 2024, Thuringia reduced its rate from 6.5 to 5 percent.

However, the biggest tax rate increase took place between 2011 and 2016. The fiscal redistribution mechanism incentivized the states to reduce the number of real estate transactions, as raising rates allows them to collect additional revenues while reducing their mandatory contributions that are based on a smaller volume of real estate transactions.

Ideally, modern real estate transfer taxes ought to work like a user feeA user fee is a charge imposed by the government for the primary purpose of covering the cost of providing a service, directly raising funds from the people who benefit from the particular public good or service being provided. A user fee is not a tax, though some taxes may be labeled as user fees or closely resemble them.

for public services related to the transfer of the property, such as maintaining property ownership records and supplying the deed to the property. However, federal law in Germany already prescribes separate mandatory fees for services like deed registration and notary expenses.

Generally, the real estate transaction tax is harmful because it prevents businesses from purchasing real estate to put it to better use, reduces people’s ability to move for better jobs, and discourages capital investment in buildings.

Research estimates that for each additional euro raised, real estate transaction tax creates an economic efficiency loss of 67 cents by reducing the number of transactions. Further, empirical studies of the German housing market find that a one percentage point rate increase reduces property prices by 3 percent on average one year after reform, mainly burdening sellers. Over time, this also reduces capital investments in buildings. States that increased their rates from 3.5 percent to 5.5 and 6.5 percent have reduced their housing construction activity by a larger amount than the additional revenue raised by higher rates. This means that even if a state used all its revenue from a higher transfer tax to build public housing, this would still leave it with a smaller housing stock.

Given these massive efficiency costs, state governments should reduce transfer taxes. The federal government can support them by removing adverse incentives from the fiscal redistribution mechanism or, better yet, by following through on recent plans to abolish the transaction tax in favour of levying a value-added tax (VAT) on new buildings. This would allow the sale of real estate to owners that can put it to better use, incentivize labor mobility, and provide needed housing. In exchange, state governments may be given more appropriate levers of tax policy, for example by absorbing the authority to levy the local business tax from local governments.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Share