The coming 2025 taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

debate is riddled with trillion-dollar questions. The revenue price tag of extending current tax policies for individuals and reversing some base broadeners for companies will exceed $3 trillion dollars.

Over the past year, Tax Foundation economists have evaluated multiple options for changing the trajectory of federal tax policies.

Using our Taxes and Growth Model, we can measure the revenue impact of tax policies conventionally (without economic feedback) and dynamically (with economic feedback).

Not all policy changes are created equal. A policy change that grows the economy can raise more (or lose less) revenue on a dynamic basis than it does on a conventional basis. On the other hand, policy changes that shrink the economy will usually raise more (or lose less) revenue on a conventional basis than on a dynamic basis.

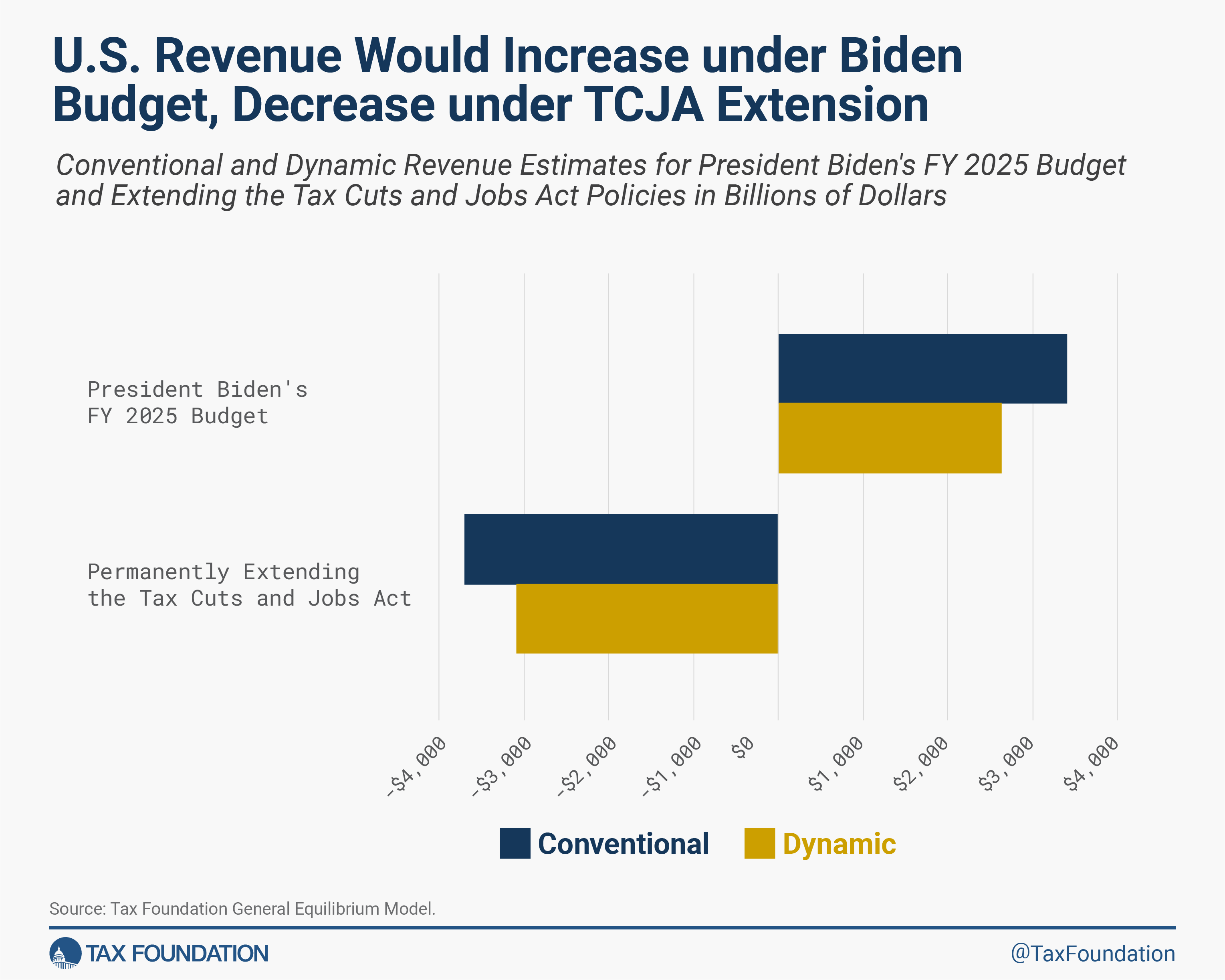

Two policy scenarios provide bookends to the upcoming tax debate. The first is extending the policies in the Tax Cuts and Jobs Act (TCJA) and reversing some of the business provisions that were designed to phase out over time.

The dynamic and conventional revenue impacts are shown in Figure 1. Extending the Tax Cuts and Jobs Act would reduce federal revenues significantly, even after accounting for the larger economy. The larger economy would support about $600 billion in additional revenue, but this is not enough to cover the cost of a multi-trillion dollar tax cut.

The second policy scenario is President Biden’s budget for fiscal year 2025, which proposes more than $3.4 trillion in net tax increases that will reduce investment and overall economic activity. The smaller economy means that, realistically, tax revenues will not hit that $3 trillion mark. Roughly $770 billion will be shaved off due to the smaller economy, resulting in our estimated net revenue increase of $2.6 trillion.

These are not the only options, of course. Policymakers will likely consider a wide range of policy changes between renewing the Tax Cuts and Jobs Act and putting the Biden budget into law.

Six examples from Tax Foundation’s recent work, summarized below, provide policymakers other options to consider, along with their revenue and economic impacts. In the coming weeks, we will release yet another option for a revenue-neutral, pro-growth reform that would keep many Tax Cuts and Jobs Act policies in place while building on some of its successes and avoiding some of its pitfalls.

Option 1: A Tax Reform for Growth and Opportunity

The first reform is transformative and would support a larger economy while also increasing tax revenue. It includes a flat taxAn income tax is referred to as a “flat tax” when all taxable income is subject to the same tax rate, regardless of income level or assets.

of 20 percent on individual income and a distributed profits taxA distributed profits tax is a business-level tax levied on companies when they distribute profits to shareholders, including through dividends and net share repurchases (stock buybacks).

of 20 percent (replacing current business tax rules), while also eliminating taxes at death and simplifying the treatment of capital gains.

In addition to supporting a larger economy, it would dramatically simplify the tax system.

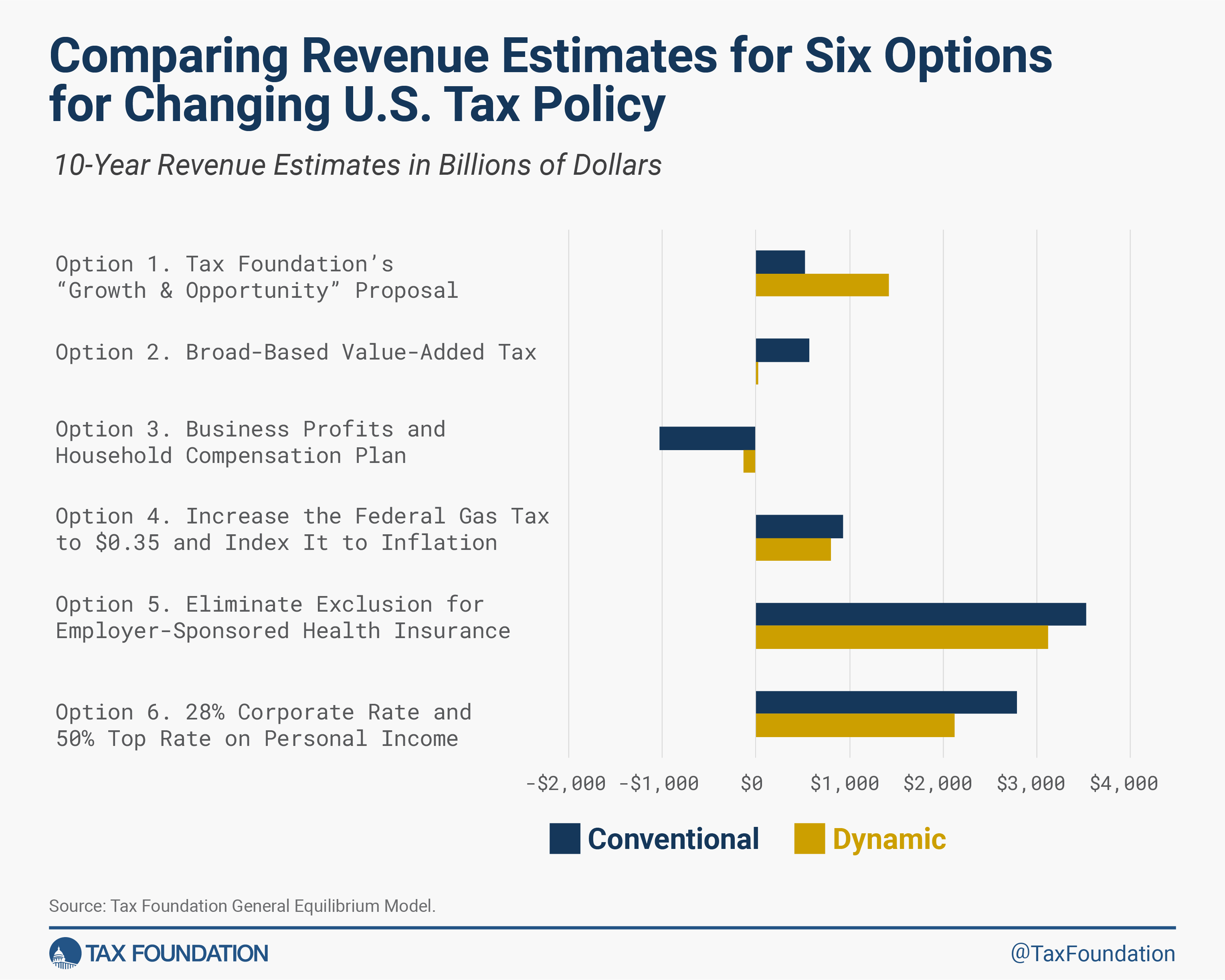

Over 10 years, this reform would increase federal revenues by $523 billion on a conventional basis and by $1.4 trillion on a dynamic basis. Read more

Option 2: Broad-Based Value-Added Tax

This reform is similarly transformative. It replaces the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax.

with a value-added tax (VAT), while also replacing current tax credits for workers and families (child tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income, rather than the taxpayer’s tax bill directly.

, earned income tax credit, and child and dependent care tax credit) with a rebate.

The VAT is much less harmful to investment and a growing economy, so the reform would lead to a larger economy than current tax policies. Over 10 years, it would increase federal revenues by $569 billion on a conventional basis and by $24 billion on a dynamic basis.

Over the longer run (beyond the 10 year time frame), this option retains a positive economic effect and is approximately revenue neutral even on a conventional basis. Read more

Option 3: Business Profits and Household Compensation Reform

This reform would replace the current corporate and individual income taxes with a tax on business cash flows and a progressive taxA progressive tax is one where the average tax burden increases with income. High-income families pay a disproportionate share of the tax burden, while low- and middle-income taxpayers shoulder a relatively small tax burden.

on household compensation with a per person credit (in lieu of the same credits replaced in Option 2).

This reform also supports a much larger economy, but it would reduce revenues, even after accounting for the larger economy. Over 10 years, this reform would decrease federal revenues by $1 trillion on a conventional basis and by $130 billion on a dynamic basis. Read more

Option 4: Increase the Federal Gas TaxA gas tax is commonly used to describe the variety of taxes levied on gasoline at both the federal and state levels, to provide funds for highway repair and maintenance, as well as for other government infrastructure projects. These taxes are levied in a few ways, including per-gallon excise taxes, excise taxes imposed on wholesalers, and general sales taxes that apply to the purchase of gasoline.

by $0.35 and Index It for InflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power.

This option may not be politically popular, but it is straightforward. The federal gas tax has not been increased since 1993 and is currently still 18.4 cents per gallon. The gas tax is a tax on consumption, and raising it would have relatively little effect on the long-term trajectory of the economy.

Over 10 years, this reform would increase federal revenues by $931 billion on a conventional basis and by $797 billion on a dynamic basis. Read more

Option 5: Eliminate Exclusion for Employer-Sponsored Health Insurance

This next reform simply broadens the tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates.

. The largest exclusion from the U.S. tax base is the exclusion for employer-sponsored health insurance. The cost is a deductible expense for employers, and it is not taxed as income for employees. However, the benefits are truly “income” in the economic sense. Even after accounting for a smaller economy, this reform would raise substantial revenue.

Over 10 years, this expansion of the tax base would increase federal revenues by $3.5 trillion on a conventional basis and by $3.1 trillion on a dynamic basis. Read more

Option 6: 28 Percent Corporate Tax Rate and 50 Percent Top Personal Income Tax Rate

As a contrast to the other revenue-raising options, this reform would increase both the corporate income tax rate and the top personal income tax rate. Currently, those rates are 21 percent for companies and 37 percent for high earners.

These reforms would distort economic decisions and lead to a smaller economy.

Over 10 years, the higher tax rates would increase federal revenues by $2.8 trillion on a conventional basis and by $2.1 trillion on a dynamic basis. Read more

Given that U.S. debt is roughly the size of our annual economic output, policymakers will face many tough fiscal choices in the coming years. The good news is there are policies that both support a larger economy and avoid adding to the debt. By choosing these options, Congress can set the U.S. on the path to fiscal sustainability.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Share