Over the last few years, concerns have been raised that the existing international taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

system does not properly capture the digitalization of the economy. Under current international tax rules, multinationals generally pay corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax.

where production occurs rather than where consumers or, specifically for the digital sector, users are located. However, some argue that through the digital economy, businesses (implicitly) derive income from users abroad but, without a physical presence, are not subject to corporate income tax in that foreign country.

To address these concerns, the Organisation for Economic Co-operation and Development (OECD) has been hosting negotiations with more than 140 countries to adapt the international tax system. The current proposal would require some of the world’s largest multinational businesses to pay some of their income taxes where their consumers are located. This proposal is referred to as Pillar One.

Pillar One would replace some existing norms for taxing multinationals and run counter to some policies that countries have put in place to tax digital companies in recent years. The most common form is a digital services tax (DST), which is a tax on selected gross revenue streams of large digital companies.

Because Pillar One is focused on changing where profits are taxed, including for many large digital companies, DSTs are expected to be repealed in a transition process anticipated to be completed by June 2024. However the OECD missed the March 31 deadline to reach an agreement on the text of Pillar One, casting doubts on when or if DSTs would ever be repealed. Additionally, in March 2024, the U.S. Treasury held a public hearing where a Joint Committee on Taxation staff report was discussed showing that Pillar One would result in a loss in U.S. federal receipts of $1.2 billion.

On October 21, 2021, a joint statement from Austria, France, Italy, Spain, the United Kingdom, and the United States laid out a plan to roll back DSTs and retaliatory tariffTariffs are taxes imposed by one country on goods or services imported from another country. Tariffs are trade barriers that raise prices and reduce available quantities of goods and services for U.S. businesses and consumers.

threats once the Pillar One rules were implemented. On November 22, 2021, the U.S. Treasury announced that Turkey had agreed to the same terms. However, given the revised timeline for the adoption of the Pillar One agreement, in an updated joint statement, the participants agreed to extend the interim period to June 30, 2024.

The joint statement outlined a crediting approach to bridge between DST liability and new Pillar One tax liability for the companies in scope of both. This would be necessary for the transition expected to occur with minimal double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income.

for the companies that would be liable under both Pillar One and current DSTs.

Apart from eliminating DSTs, an agreement on the treatment under Amount A of cross-border withholdingWithholding is the income an employer takes out of an employee’s paycheck and remits to the federal, state, and/or local government. It is calculated based on the amount of income earned, the taxpayer’s filing status, the number of allowances claimed, and any additional amount of the employee requests.

taxes—often used by developing countries to tax the gross amount of transactions in related digital services—also needs to be reached. Additionally, the U.S. Treasury Department announced that it is negotiating the definition of DSTs as members of the U.S. Congress expressed concerns that Pillar One may not provide sufficient protection for all forms of digital taxes.

For now, as work on Pillar One continues (reflected in the most recent policy document), nine policies from eight different countries might be removed if Pillar One gets adopted.

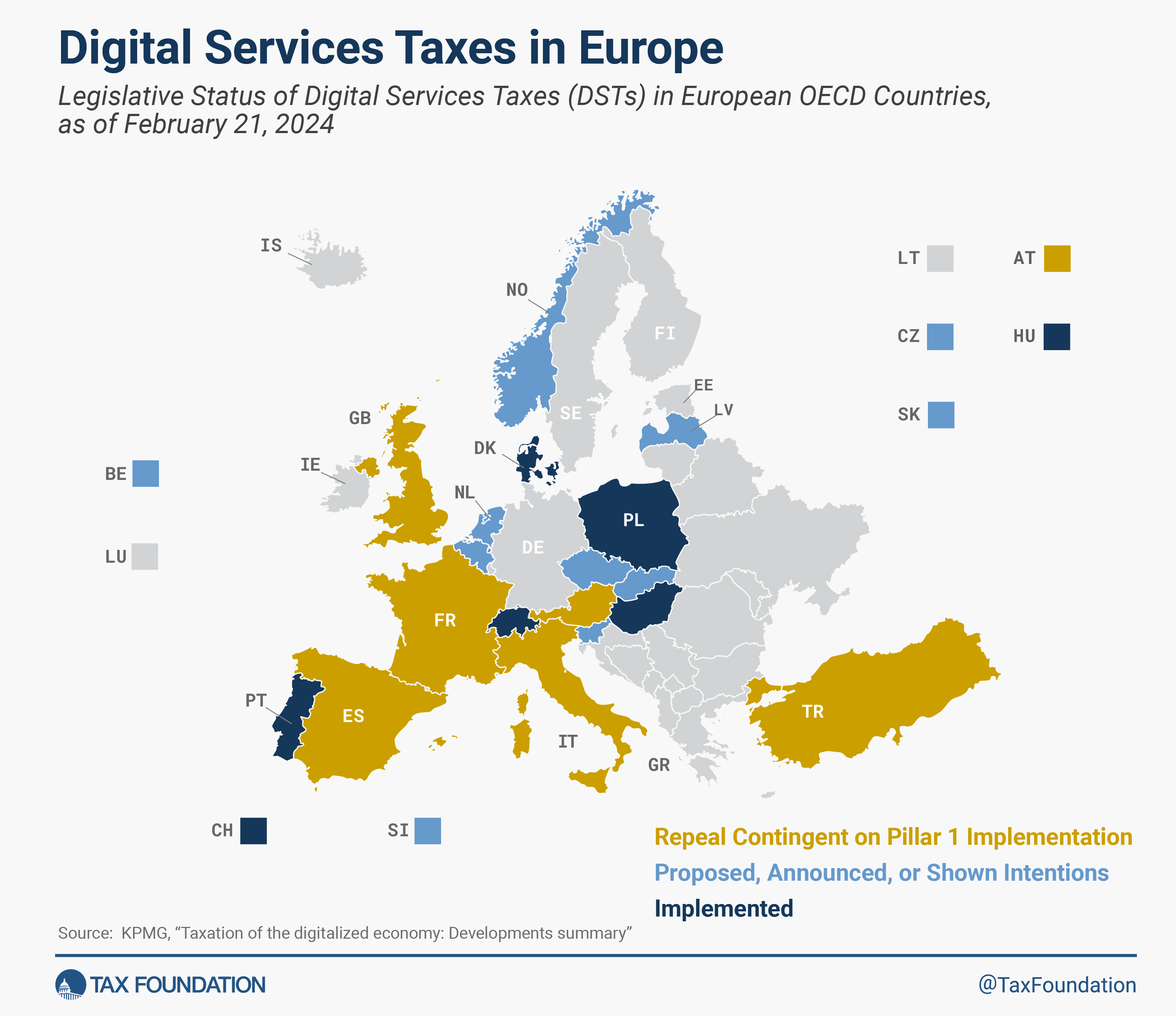

However, these are not the only countries that may be impacted by the OECD agreement. About half of all European OECD countries have either announced, proposed, or implemented a DST. Because these taxes mainly impact U.S. companies and are thus perceived as discriminatory, the United States responded to the policies with retaliatory tariff threats, urging countries to abandon unilateral measures.

Austria, Denmark, France, Hungary, Italy, Poland, Portugal, Spain, Switzerland, Turkey, and the United Kingdom have implemented a DST. Belgium and the Czech Republic have published proposals to enact a DST, and Latvia, Norway, Slovakia, and Slovenia have either officially announced or shown intentions to implement such a tax.

The proposed and implemented DSTs differ significantly in their structure. For example, while Austria and Hungary only tax revenues from online advertising and Denmark’s DST applies only to streaming services, France’s tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates.

is much broader, including revenues from the provision of a digital interface, targeted advertising, and the transmission of data collected about users for advertising purposes. The tax rates range from 1.5 percent in Poland to 7.5 percent in both Hungary and Turkey (although Hungary’s tax rate was reduced to 0 percent up to December 2024).

These DSTs were generally considered to be interim measures until an agreement could be reached at the OECD level. If such an agreement is reached, it will be important to monitor how countries change or repeal their DSTs. At the same time, the United Nations has added special provisions for income from automated digital services to the UN Model Tax Convention (see Article 12B), which would apply to treaty parties who agree to its inclusion.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Share