Unless Congress acts, Americans are in for a taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities.

hike in 2026.

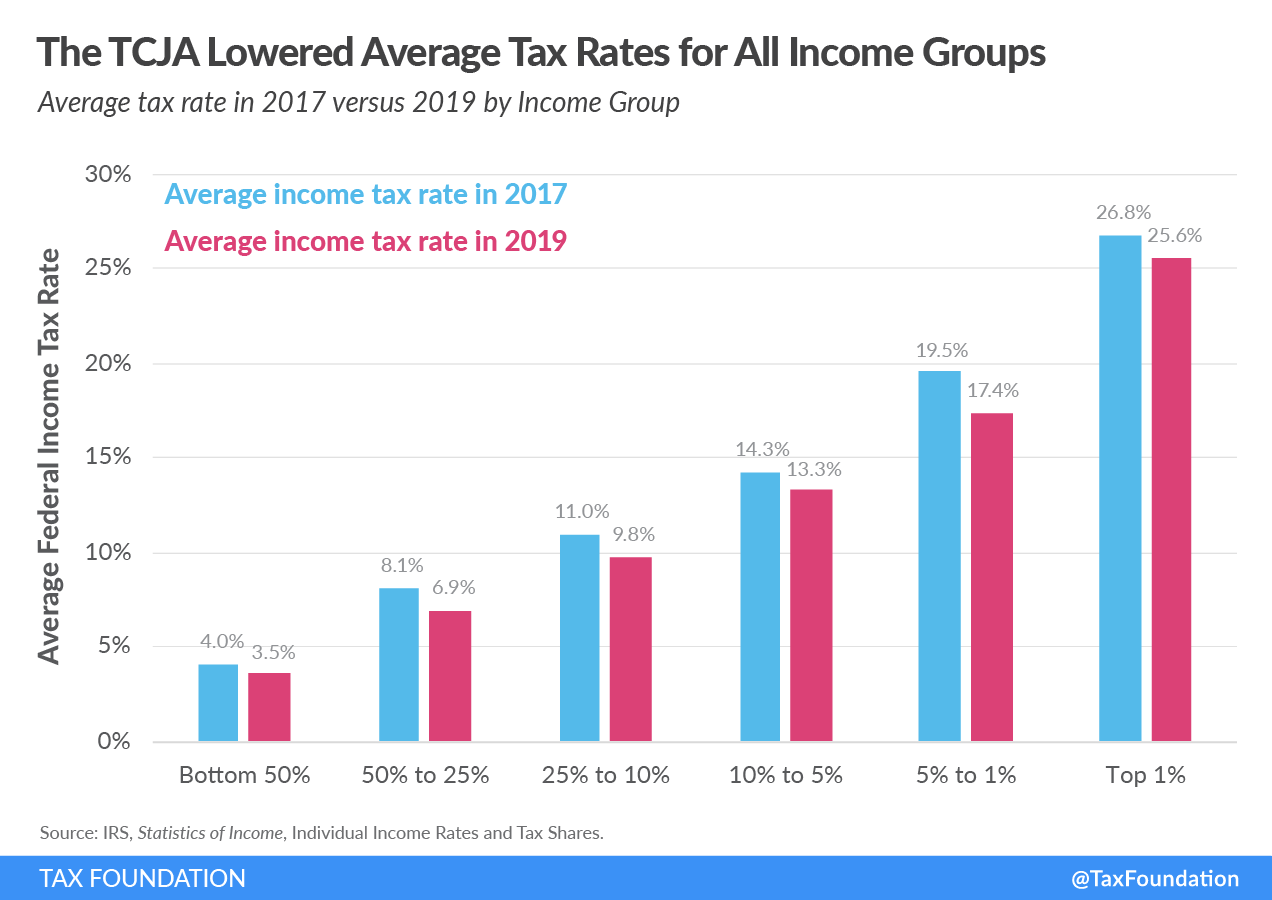

Why? In addition to business tax cuts and changes to the international tax system, the 2017 Tax Cuts and Jobs Act (TCJA) overhauled the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S.

code, cutting taxes for all income groups on average. But these cuts are set to expire after the end of 2025, sticking most of us with a larger tax bill.

The U.S. has a progressive income tax system, so the more you make, the higher your marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax.

. The TCJA reduced most of the seven individual income tax rates, widened brackets, and doubled the standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act as an incentive for taxpayers not to itemize deductions when filing their federal income taxes.

, among other things that were beneficial for individual taxpayers.

How Will My Tax Bill Change?

When the TCJA’s individual income tax changes expire, the amount you pay in federal income taxes will likely go up if there is no action from Congress.

Consider a single worker who makes $60,000 per year and takes the standard deduction ($13,850 in 2023). After subtracting the standard deduction, her taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income.

is reduced to $46,150, lowering her overall tax burden. The first $11,000 is taxed at 10 percent, income between $11,001 and $44,725 is taxed at 12 percent, and income between $44,726 and $46,150 is taxed at 22 percent. Her total federal income tax liability under the TCJA is $5,460. (If that sounds complicated, check out How Do Tax Brackets Work?)

Under the pre-TCJA tax rates and brackets, with a standard deduction of $8,300 (after adjusting for inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power.

) and a personal exemption of $5,300, her tax liability would be $7,254—a tax hike of $1,794. That’s the cost of letting the provisions expire.

This is a simplified example, and individual scenarios will vary, but most people can expect to pay more in federal income taxes by 2026.

How Do Income Tax Hikes Affect the Economy

Decades of economic research show that high marginal income tax rates create disincentives to work, save, and invest. This makes income taxes the second most harmful tax type to economic growth, behind corporate taxes.

Economic growth may seem like a distant concept, but the impact on you is real. Individual income tax increases mean less money in your pocket and a weaker economy.

What Would Making the TCJA’s Individual Provisions Permanent Do?

If, however, Congress makes the TCJA’s individual income tax provisions permanent, the economy would grow, employment would increase, and incomes would rise. The trade-off: less federal revenue.

While permanency would increase GDP by 0.5 percent, employment by 686,000 full-time equivalent jobs, and after-tax incomes by 2.4 percent on average over the next decade, the federal government would take in $2.6 trillion less after accounting for economic growth.

How Should Policymakers Respond?

Making the TCJA’s individual income tax changes permanent would stave off a sudden tax increase and grow the economy, but it would add to the deficit, which just topped the highest in U.S. history, outside of the pandemic years.

That means Congress will have some difficult decisions to make in 2025. As it decides which parts of the TCJA deserve to stay and which should go, it should remember that not all taxes are created equal—some are better at raising revenue with less economic harm. Policymakers should prioritize these less harmful taxes and maintain their commitment to both fiscal responsibility and economic growth.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Share